Mostly Cloudy, 39° F

Park County officials worked hard to get out the word about the state’s newly expanded property tax refund program, and the effort appears to have paid off for taxpayers.

State data shows …

This item is available in full to subscribers.

The Powell Tribune has expanded its online content. To continue reading, you will need to either log in to your subscriber account, or purchase a subscription.

If you are a current print subscriber, you can set up a free web account by clicking here.

If you already have a web account, but need to reset it, you can do so by clicking here.

If you would like to purchase a subscription click here.

Please log in to continue |

|

Park County officials worked hard to get out the word about the state’s newly expanded property tax refund program, and the effort appears to have paid off for taxpayers.

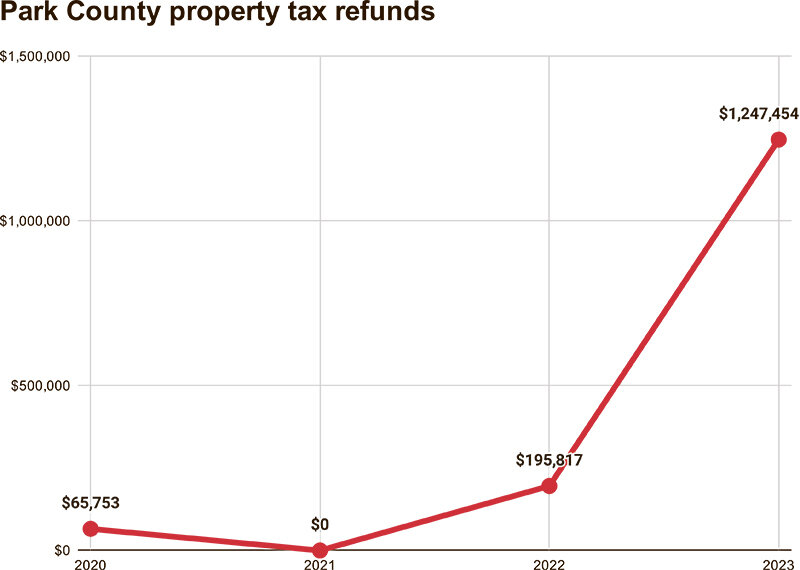

State data shows nearly 1,174 homeowners within the county received refunds this year — more than four times the number of people who qualified for relief last year and nearly 11 times as many as 2020.

Park County Treasurer Barb Poley was among those who encouraged local residents to apply for relief and she was pleased to see so many homeowners receive refunds. Of course, the large number of recipients also “shows the tremendous need, and that we have so many people in that [lower] income,” Poley added, “so on the other side, it’s too bad that we have to have that program.”

Wyoming lawmakers made the refunds more generous during last winter’s General Session and they significantly expanded the eligibility.

Thanks to the changes, homeowners can get as much as 75% of their property taxes refunded from the prior year, up from 50%. Additionally, a Park County household could have earned as much as $86,400 in 2022 and still qualify — up from a previous cap of $51,840; similarly, each adult in the home can own $150,000 worth of assets (on top of the house, one vehicle per adult and retirement accounts), which was a bump from $100,000.

Between the changes to the program and still-skyrocketing property taxes, state officials expected to see a surge in applications and refunds. But they wound up underestimating the demand.

After refunding $1.86 million to 3,085 residents last year, the State of Wyoming repaid a whopping $8.27 million to 8,818 homeowners over the summer. That was nearly $2 million more than lawmakers had budgeted.

While every single county saw the number of refunds jump by at least 50%, Park County led the pack. The county had the most recipients on a per capita basis and the biggest percentage jump over last year. The 1,174 Park County residents received nearly $1.25 million, or an average of $1,062.57 per homeowner. That’s up from 108 recipients and $65,753 worth of refunds in 2020, before the COVID-19-induced surge that hit the local real estate market.

At a Joint Revenue Committee meeting earlier this month, Sen. Tim French (R-Powell) said the revamped refund program “means a lot to a lot of people.” He recalled hearing from one local resident who “was so thankful, it was unbelievable.”

“He just went on and on and on and I said it wasn’t me alone,” French said, “it was the entire Legislature and [the Wyoming Department of Revenue], a lot of people were involved.”

Park County Assessor Pat Meyer included instructions on how to apply for refunds when he sent out residents’ assessment notices earlier this year and Poley placed ads and held multiple meetings in Powell, Cody and Meeteetse in an effort to reach eligible homeowners.

“There [were] a lot of people that helped us get this done,” Poley said, mentioning the Powell Senior Center as another example.

Department of Revenue Director Brenda Henson said she appreciated the many people who spread the word across the state — such as Gov. Mark Gordon’s office, county treasurers, assessors and AARP Wyoming. Henson also noted that five counties launched their own programs to provide even bigger refunds.

“I truly believe there are folks out there that are trying to assist those that need relief the most,” Hanson said.

The director was also impressed by a pair of Wyoming homeowners who returned their checks after realizing they’d made mistakes on their applications.

“One of them literally said, ‘You know what? I lied: I completely forgot about this inheritance that I have,’” Hanson said, adding that their candor “does your heart good.”

At its Oct. 2-3 meeting, the Joint Revenue Committee voted to sponsor a bill that would further expand the refund program to those with higher incomes, though they would receive less relief. It’s among a slew of property tax measures the panel is sponsoring or still considering, including a Meyer-backed effort to limit how much a resident’s taxes can rise in a given year.

Property values continued to increase in 2022, which means Wyoming homeowners are again facing notably higher property tax bills. In 18 of the state’s 23 counties, the median tax bill for residential properties rose more than 10% this year, according to Department of Revenue data. The list was topped by a 31% jump in Teton County, where the median property tax bill is now $11,124.80; the median bill in Park County jumped 14% to $2,604.49.

Eligible homeowners can start applying for refunds for the 2023 tax year next spring and with taxes on the rise again, Poley assumes they’ll need another public awareness campaign.