Clear, 51° F

If you're in the market for a car in 2024, you'll have plenty to choose from at a dealership near you—something that couldn't be taken for granted just a few years ago. Nonetheless, while supply of both new and used vehicles on U.S. dealer lots have returned to historically normal levels, the price of driving certainly hasn't. That's especially true once one considers so-called hidden costs like auto insurance, registration fees and, depending on where you live, parking.

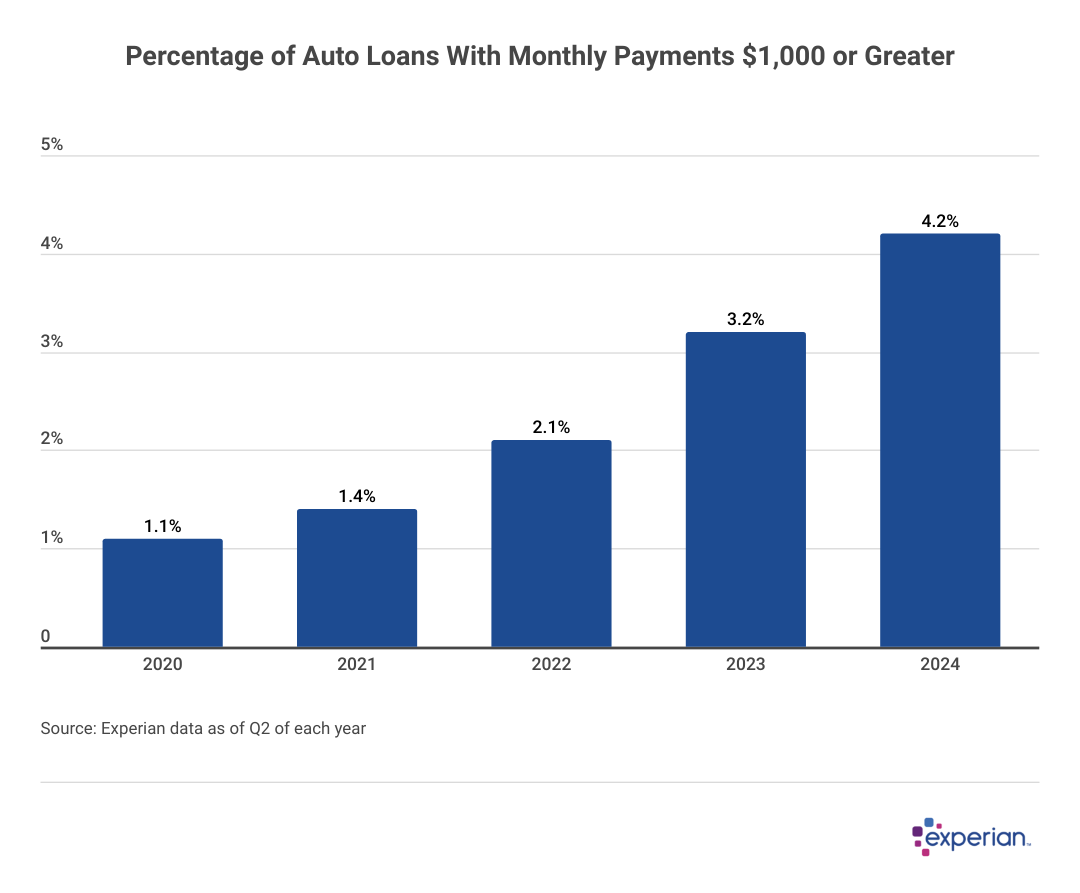

Moreover, the most in-your-face cost of all, the auto payment, hasn't declined for most drivers still paying off their old loans—a portion of which were borrowed when cars were scarce and rates for car loans shot up. Borrowers are still paying down those higher car loan amounts, Experian data shows. More drivers are spending more than $1,000 per month (per vehicle) keeping their car loans current in 2023, Experian reports.

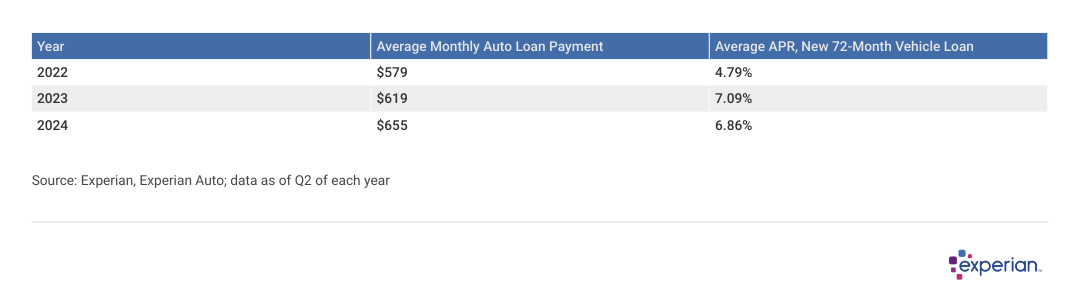

More than 4% of drivers are sending four-digit payments to their lenders to pay down their auto loans each month, a full percentage point more than in 2023, when dealer inventory was still scarce and car loan rates were peaking. As of June 2024, the average auto loan payment among consumers was $655, up from $619 in 2023.

Why are more than 4% of drivers paying $1,000 or more in 2024, even though incentives are increasing and interest rates are falling? One factor is when these loans were originated. Most of the auto loans with balances today were made earlier in the decade, when fewer drivers had bargaining power at the dealership. Many of those drivers are still stuck with the unfavorable terms for that era today.

Another reason for the super-high payments are the sales prices of cars themselves, which although finally decelerating, are still up in both new and used cars, according to a broad survey of the dealership landscape from Cox Automotive.

And getting unstuck from a too-high car payment isn't as easy as it used to be, especially for drivers hoping to trade in their current vehicle for a new one. One obstacle (among several): Many drivers are finding that trade-in values aren't as lucrative as when vehicles were scarce during the pandemic-era supply disruptions. If anything, dealerships still have a glut of used (and new) inventory.

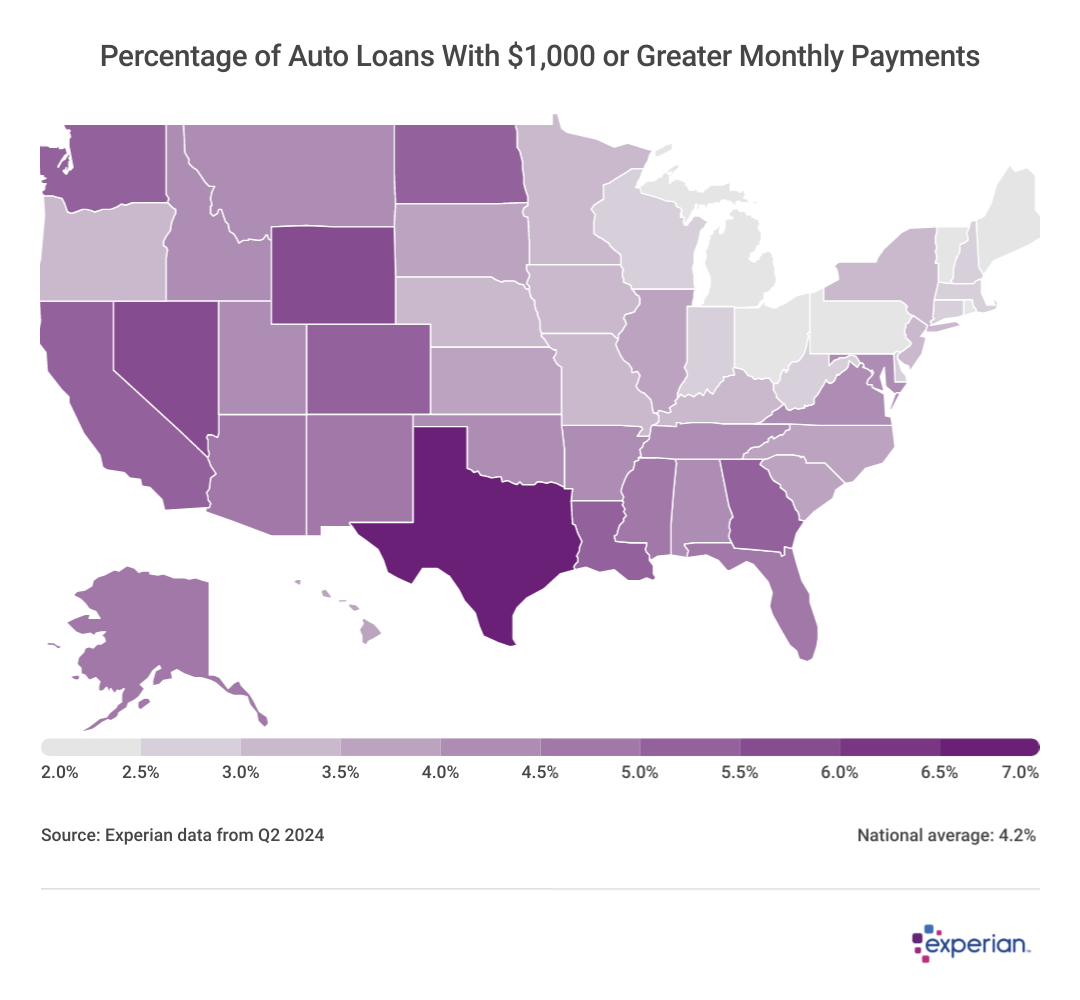

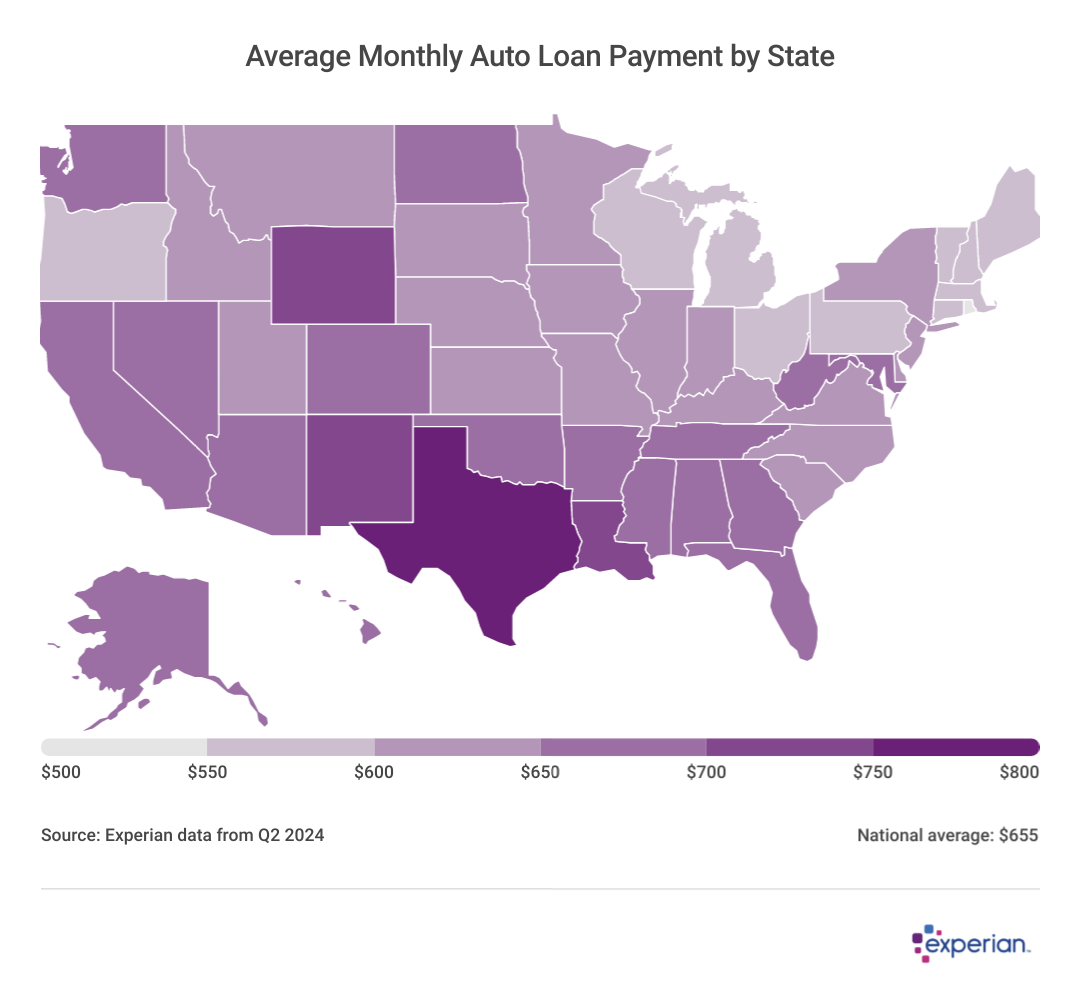

It's probably no longer surprising to learn that states where drivers put the most miles on their vehicles are where more are digging deeper to pay off their auto loans. Texas, as it was last year, is in a league of its own, with 6.9% of borrowing drivers paying $1,000 or more monthly for each car with a loan. That's a full percentage point more than the next seven states where more than 5% of drivers are paying that much or more monthly.

Meanwhile, New England and the Great Lakes states have only half the rate of borrowers with $1,000 or higher monthly auto payments. And, according to Experian data, average monthly loan payments in these states are closer to, if not lower than, the national auto loan monthly payment average of $655.

With auto loan terms increasing—72- and even 84-month auto loans are becoming more common—it's perhaps less surprising that higher loan payments continue to persist, even as car prices and interest rates are declining in 2024. Fortunately for borrowers whose credit scores may have improved since they first financed their car, auto loan refinancing can possibly lower the APR a driver may currently be paying on their loan.

Consider a driver with a car loan balance of $35,000 who still has three and a half years of making a $1,008 monthly payment, as their current loan's APR is 11%. Presuming the vehicle has held its value (in other words, the driver isn't considered upside-down on their loan), by refinancing, the borrowing rate could lower to 7% for those with good or better credit and monthly payments could drop to $942 for the remainder of the new loan. The nearly $3,000 savings in interest payments would likely come in handy for those pesky additional costs of car ownership.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of its consumer credit database that may include use of the FICO® Score 8 version. Different sampling parameters may generate different findings compared with other similar analyses. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.